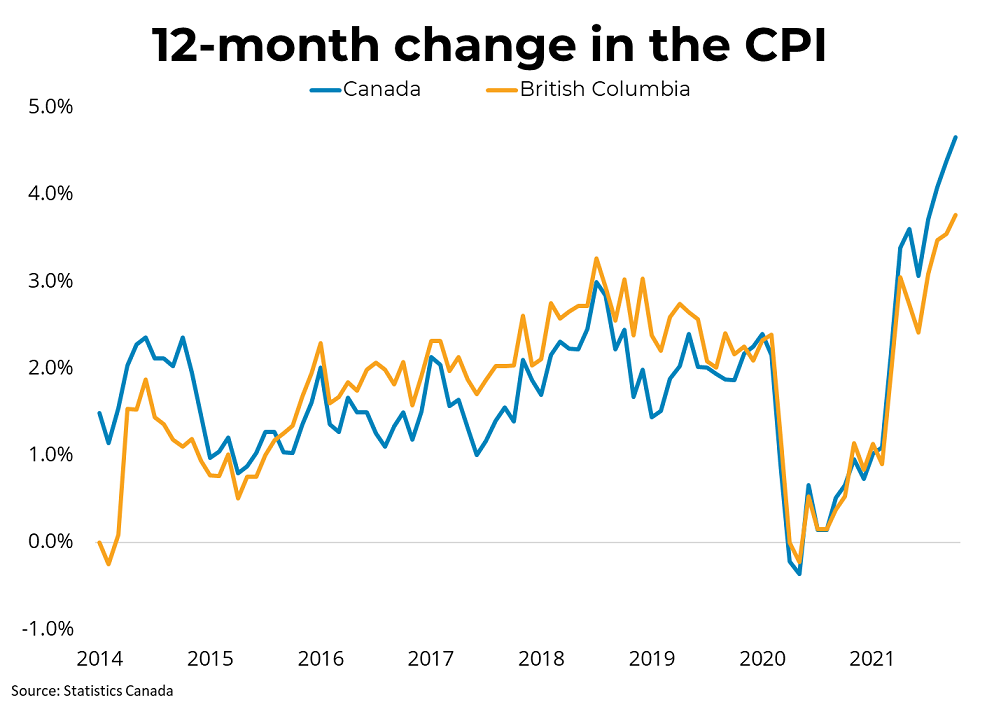

Canadian prices, as measured by the Consumer Price Index (CPI), rose 4.7% on a year-over-year basis in October, rising at the fastest rate since 2003. On a month-over-month basis, the CPI was up 0.7% in October. The Bank of Canada's preferred measures of core inflation (which use techniques to strip out volatile elements) rose an average of 2.7% year-over-year in October. Major drivers of the year-over-year price increase included transportation prices (+10.1%), shelter (+4.8%) and food prices (+3.8%) partly on continuing supply-chain difficulties. In BC, consumer prices were up 0.43% month-over-month, and up 3.8% on a year-over-year basis.

Inflation continues to run ahead of the Bank of Canada's 2 per cent target. The driving force behind rising prices in October was a 10% increase in transportation costs due to rising gasoline prices. Inflation from shelter costs was up month-over-month as home prices trended higher after flattening out over the summer. Those categories continue to account for about 60% of the year-over-year rise in consumer prices. We expect this elevated level of inflation to persist through next year before prices begin moderating. The Bank of Canada is clearly concerned about rising consumer prices and have signaled that it will begin raising its policy rate in the second or third quarter of 2022.

Copyright British Columbia Real Estate Association. Reprinted with permission.

Subscribe with RSS Reader

Subscribe with RSS Reader

Comments:

Post Your Comment: