Posted on

April 29, 2022

by

Steve Flynn

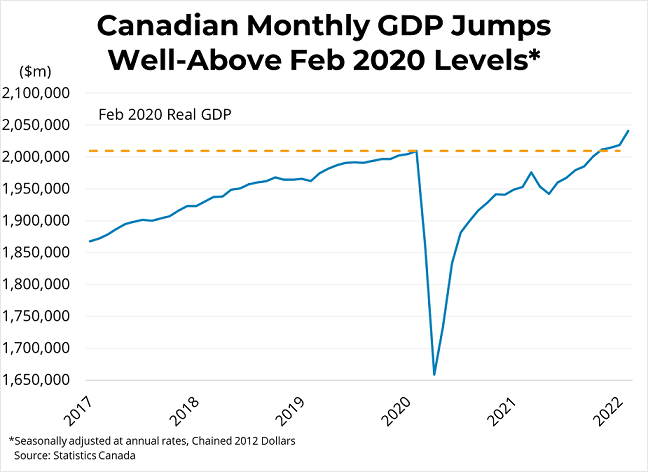

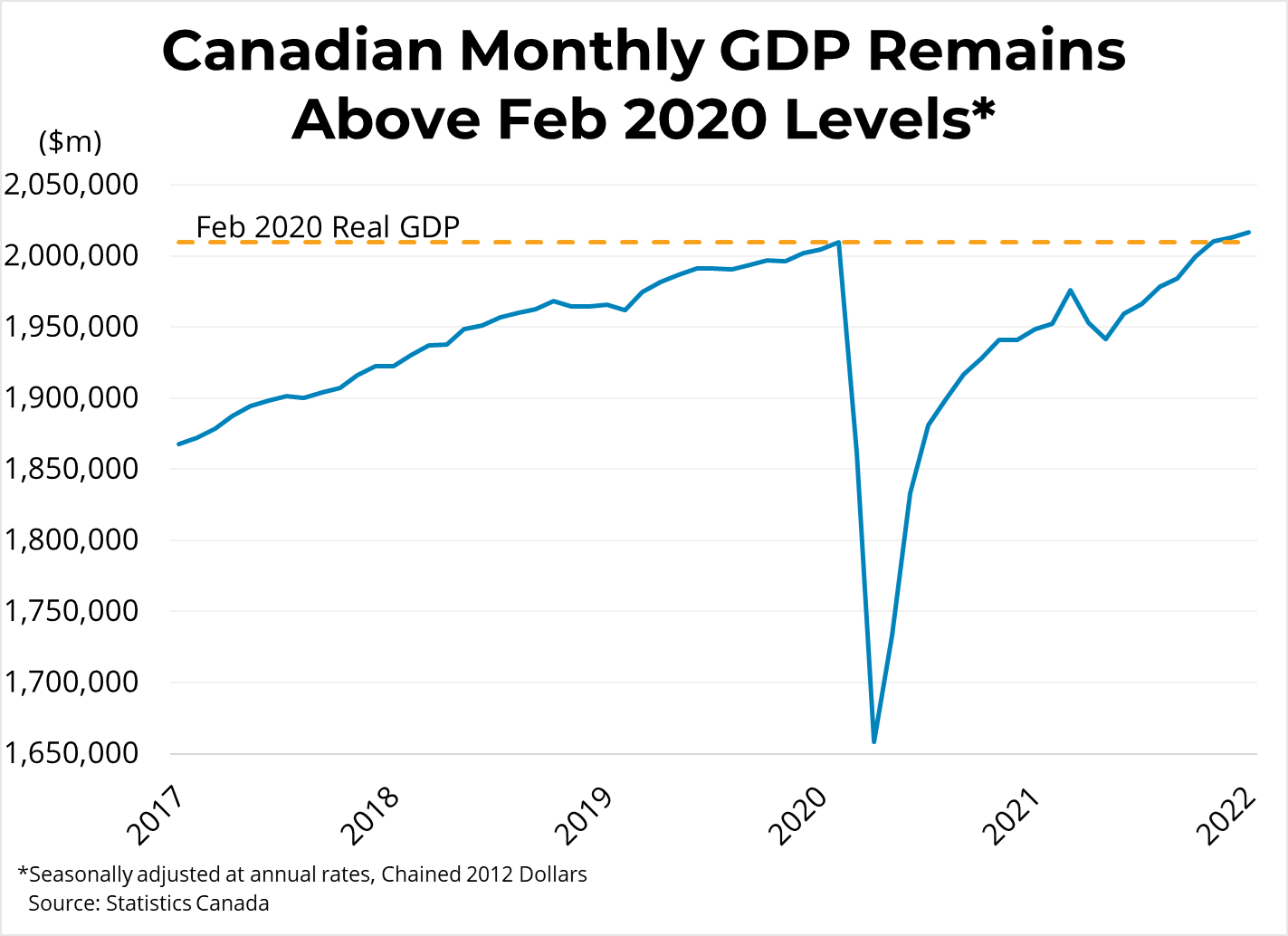

The Canadian economy jumped 1.1 per cent in February, up for the ninth consecutive month. Goods-producing sectors rose 1.5 per cent while services-producing industries were up 0.9 per cent. Canadian real GDP is roughly 1.5 per cent above its pre-pandemic, February 2020 level. Preliminary estimates suggest that output in the Canadian economy grew 0.5 per cent in March.

With a a very high figure for February and strong preliminary numbers continuing into March, the Canadian economy appears to be on a strong growth path as it emerges from the Omicron-related slowdown. The Bank of Canada has noted that the slack in the Canadian economy is largely absorbed, which is partly why it has hiked rates from 0.25 in March to 1 per cent currently. Amid strong GDP growth and high inflation, the expectation is that the bank will again raise rates at its upcoming June 1st announcement by another 0.5 per cent. BCREA forecasts that the bank will continue raising rates until the overnight policy rate reaches 1.75 per cent, the level which prevailed prior to the COVID-19 crisis.

Copyright British Columbia Real Estate Association. Reprinted with permission.

Posted on

April 22, 2022

by

Steve Flynn

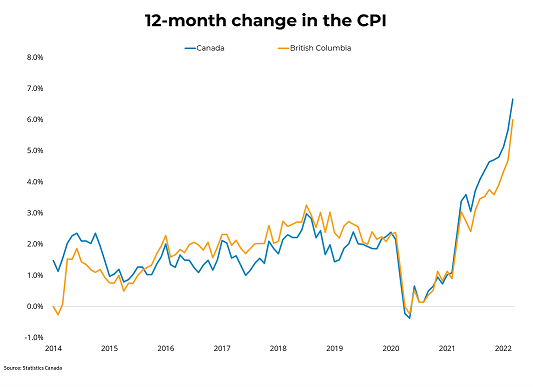

Canadian prices, as measured by the Consumer Price Index (CPI), rose 6.7% on a year-over-year basis in March, up from 5.7% in February. This was the largest gain since January 1991 (+6.7%). According to Statistics Canada, price rises were broad-based, with groceries up 8.7% year over year, gasoline up 39.8%, durable goods up 7.3%, restaurants up 5.4%, and shelter costs up 6.8%. Excluding gasoline, the CPI rose 5.5% year over year in March. On a monthly basis, prices were up 1.4%, following an increase of 1% in February. In BC, consumer prices rose 6.0% year-over-year.

With inflation stubbornly high through the first quarter of the year and unemployment in Canada hitting a record low, the Bank of Canada is now planning to bring its policy rate back to a neutral level, between 1.75 and 2.75 per cent, much faster than previously anticipated. We expect the Bank will continue to tighten until there is clear evidence that inflation and inflation expectations are moderating back to normal levels. This more aggressive policy stance has already been priced into 5-year fixed mortgage rates, which are now on a path to surpassing 4 per cent for the first time in a decade.

Copyright British Columbia Real Estate Association. Reprinted with permission.

Posted on

April 19, 2022

by

Steve Flynn

Canadian housing starts fell by 4.0k (-1.6%) to 246.2k units in March at a seasonally-adjusted annual rate (SAAR). Comparing year-over-year, starts were down from March of 2021 (-25.4% y/y). Single-detached housing starts rose 7.1% to 83.9k, while multi-family and others declined 5.6% to 162.3k (SAAR).

In British Columbia, starts were down 6.7% in March, falling to 32.6k units SAAR in all areas of the province. In areas in the province with 10,000 or more residents, single-detached starts rose 4.7% m/m to 8.1k units while multi-family starts declined 11.7% to 20.6k units. Starts in the province were 54.1% below the levels from March 2021. Starts were down by 2.9k units in Vancouver, 3.6k in Victoria, and 0.4k in Abbotsford, but rose 1.5k in Kelowna from last month. The 6-month moving average trend declined 1.5% to 39.6k in BC in March.

Copyright British Columbia Real Estate Association. Reprinted with permission.

Posted on

April 16, 2022

by

Steve Flynn

The Bank of Canada raised its overnight policy rate by 0.5 per cent to 1 per cent. This was the first rate increase of more than 0.25 per cent since May 2000. The Bank will also begin so called "quantitative tightening" , meaning it will be shrinking its balance sheet over time, reversing the expansion that occurred in response to the pandemic. In the statement accompanying the decision, the Bank noted that growth in Canada is strong and the economy is moving into a phase of excess demand with tight labour markets and significant pressure on consumer prices.

The Bank expects the Canadian economy will grow 4.25 per cent this year before slowing to 3.25 per cent next year. On inflation, the Bank anticipates inflation will gradually decline from its current 6 per cent rate to 2.5 per cent by the second half of 2023. Finally, the Bank signalled that interest rates will need to rise further and that the timing and and pace of future increases will be guided by the Banks ongoing assessment of the economy.

With inflation stubbornly high through the first quarter of the year, exacerbated by the impact of the Russian invasion of Ukraine, and unemployment in Canada hitting a record low, the Bank has opted for a more aggressive stance. Clearly the Bank is now planning to bring its policy rate back to a neutral level, between 1.75 and 2.75 per cent, much faster than previously anticipated. We expect the Bank will continue to tighten until there is clear evidence that inflation and inflation expectations are moderating back to normal levels. This more aggressive policy stance has already been priced into 5-year fixed mortgage rates, which are now on a path to surpassing 4 per cent for the first time in a decade.

Copyright British Columbia Real Estate Association. Reprinted with permission.

Posted on

April 14, 2022

by

Steve Flynn

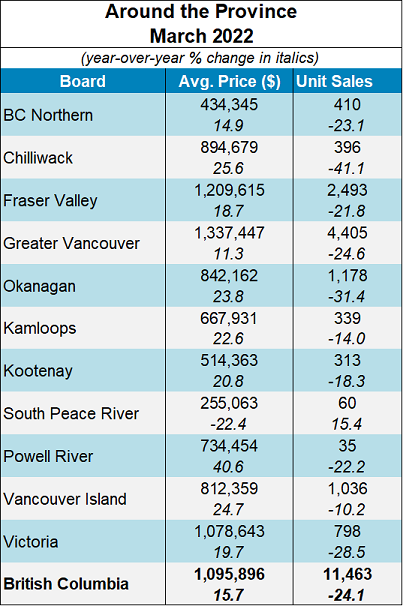

The British Columbia Real Estate Association (BCREA) reports that a total of 11,463 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in March 2022, a decrease of 24.1 per cent from a record March 2021.

The average MLS® residential price in BC was $1.096 million, a 15.7 per cent increase from $946,813 recorded in March 2021. Total sales dollar volume was $12.6 billion, a 12.1 per cent decline from the same time last year.

“Home sales in the province continue to moderate from record highs of this time last year,” said BCREA Chief Economist Brendon Ogmundson. “Given the sharp rise in Canadian mortgage rates and expected tightening from the Bank of Canada, activity will likely slow further in the second half of this year.”

Provincial active listings were 12.4 per cent lower than this time last year with the total inventory of homes for sale in the province at under 20,000 units. That level of inventory remains well below the roughly 40,000 listings needed for a balanced market.

Year-to-date, BC residential sales dollar volume was down 4.1 per cent to $28.8 billion, compared with the same period in 2021. Residential unit sales were down 20.1 per cent to 26,577 units, while the average MLS® residential price was up 20 per cent to $1.086 million.

Copyright British Columbia Real Estate Association. Reprinted with permission.

Posted on

April 12, 2022

by

Steve Flynn

I have sold a property at 38 21960 RIVER RD in Maple Ridge. Don’t miss out on this beautiful 3 bed 2 bath townhome within steps of the Westcoast Express. This home has updates throughout, featuring barn doors, custom mud room, ship lap wall features, modern kitchen with stainless steel appliances and white subway tile backsplash, a huge patio, and one of the nicest garages you will ever see!!! This townhouse needs to be viewed to be truly appreciated!

Posted on

April 10, 2022

by

Steve Flynn

CONGRATULATIONS to my HAPPY Buyers!

Posted on

April 7, 2022

by

Steve Flynn

Canadian employment rose by 73,000 (+0.4%) in March hitting a fresh record for employment, according to Statistics Canada. The labour market is increasingly tight, with the Canadian unemployment rate declining to 5.3%, the lowest rate on record since comparable data became available in 1976. The total hours worked rose 1.3% in March while average hourly wages were up 3.4% on a year-over-year basis, up from 3.1% in February. Wage gains are below the inflation rate, however, which clocked in at 5.7% year-over-year in February.

Public health measures continued to ease prior to the survey reference week in March, driving labour market gains. Employment growth occurred in both the services-producing (+42,000; +0.3%) and the goods-producing (+31,000; +0.8%) sectors in March. The labour force participation rate was essentially unchanged at 65%.

BC's labour market continues to moderately outperform Canada's, with employment rising by 10,500 (0.4%) in March. Metro Vancouver's employment growth once again outpaced the province, with employment rising 9,300 (0.6%). Seasonally-adjusted employment in BC is not only above pre-pandemic levels, but hit a record high for a 6th consecutive month. The unemployment rate ticked upwards slightly in March, reaching 5.1%. Among the provinces, only Quebec and Saskatchewan have lower unemployment rates.

Copyright British Columbia Real Estate Association. Reprinted with permission.

Posted on

April 5, 2022

by

Steve Flynn

While down from last year’s record numbers, home sale activity in Metro Vancouver’s* housing market remained elevated in March:

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 4,344 in March 2022, a 23.9 per cent decrease from the 5,708 sales recorded in March 2021, and a 26.9 per cent increase from the 3,424 homes sold in February 2022. Last month’s sales were 25.5 per cent above the 10-year March sales average.

“March of 2021 was the highest selling month in our history. This year’s activity, while still elevated, is happening at a calmer pace than we experienced 12 months ago,” Daniel John, REBGV Chair said. “Home buyers are keeping a close eye on rising interest rates, hoping to make a move before their locked-in rates expire.”

There were 6,673 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in March 2022. This represents a 19.5 per cent decrease compared to the 8,287 homes listed in March 2021 and a 22 per cent increase compared to February 2022 when 5,471 homes were listed.

The total number of homes currently listed for sale on the MLS® system in Metro Vancouver is 7,628, a 16.6 per cent decrease compared to March 2021 (9,145) and a 13.1 per cent increase compared to February 2022 (6,742). “We’re still seeing upward pressure on prices across all housing categories in the region. Lack of supply is driving this pressure,” John said. “The number of homes listed for sale on our MLS® system today is less than half of what’s needed to shift the market into balanced territory.”

For all property types, the sales-to-active listings ratio for March 2022 is 56.9 per cent. By property type, the ratio is 38.8 per cent for detached homes, 73.3 per cent for townhomes, and 70.3 per cent for apartments. Generally, analysts say downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,360,500. This represents a 20.7 per cent increase over March 2021 and a 3.6 per cent increase compared to February 2022.

Sales of detached homes in March 2022 reached 1,291, a 34.3 per cent decrease from the 1,965 detached sales recorded in March 2021. The benchmark price for a detached home is $2,118,600. This represents a 23.4 per cent increase from March 2021 and a 3.6 per cent increase compared to February 2022.

Sales of apartment homes reached 2,310 in March 2022, a 14.3 per cent decrease compared to the 2,697 sales in March 2021. The benchmark price of an apartment home is $835,500. This represents a 16.8 per cent increase from March 2021 and a 3.4 per cent increase compared to February 2022.

Attached home sales in March 2022 totalled 743, a 29.0 per cent decrease compared to the 1,046 sales in March 2021. The benchmark price of an attached home is $1,138,300. This represents a 28.1 per cent increase from March 2021 and a 4.4 per cent increase compared to February 2022.

* Areas covered by the Real Estate Board of Greater Vancouver include: Burnaby, Coquitlam, Maple Ridge, New Westminster, North Vancouver, Pitt Meadows, Port Coquitlam, Port Moody, Richmond, South Delta, Squamish, Sunshine Coast, Vancouver, West Vancouver, and Whistler.

Copyright British Columbia Real Estate Association. Reprinted with permission.

Posted on

April 4, 2022

by

Steve Flynn

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver* is currently $1,360,500. This represents a 3.6% increase from February 2022 and a a 20.7% increase from March 2021.

Specifically:

- The benchmark price for detached homes increased 3.6% from Feb 2022 and increased 23.4% from Mar 2021.

- The benchmark price for townhouses increased 4.4% from Feb 2022 and increased 28.1% from Mar 2021.

- The benchmark price for apartment/condos increased 3.4% from Feb 2022 and increased 16.8% from Mar 2021.

* Areas covered by the Real Estate Board of Greater Vancouver include: Burnaby, Coquitlam, Maple Ridge, New Westminster, North Vancouver, Pitt Meadows, Port Coquitlam, Port Moody, Richmond, South Delta, Squamish, Sunshine Coast, Vancouver, West Vancouver, and Whistler.

Copyright British Columbia Real Estate Association. Reprinted with permission

Posted on

April 1, 2022

by

Steve Flynn

The Canadian economy rose 0.2% in January, up for the eighth consecutive month. Goods-producing sectors rose 0.8% while services-producing industries remained flat on Omicron-related restrictions. Canadian real GDP is roughly 0.4 per cent above its pre-pandemic, February 2020 level. Preliminary estimates suggest that output in the Canadian economy grew 0.8% in February.

With a high preliminary estimate for February, the Canadian economy appears to be on a strong growth path as it emerges from the Omicron-related slowdown. The Bank of Canada has noted that the slack in the Canadian economy is largely absorbed, which is partly why it hiked rates from 0.25% to 0.5% in early March. Amid strong GDP growth and high inflation, the expectation is that the bank will again raise rates at its upcoming announcement on April 13th by another 0.25% or even 0.5%. BCREA forecasts that the bank will continue raising rates until the overnight policy rate reaches 1.75 per cent, the level which prevailed prior to the COVID-19 crisis.

Copyright British Columbia Real Estate Association. Reprinted with permission.

Categories:

Abbotsford West, Abbotsford Real Estate

|

Bolivar Heights, North Surrey Real Estate

|

Brentwood Park, Burnaby North Real Estate

|

Brighouse, Richmond Real Estate

|

Burnaby

|

Burnaby Real Estate

|

Burnaby South Real Estate

|

Cape Horn, Coquitlam Real Estate

|

Cariboo, Burnaby North Real Estate

|

Central BN, Burnaby North Real Estate

|

Central Coquitlam, Coquitlam

|

Central Coquitlam, Coquitlam Real Estate

|

Champlain Heights, Vancouver East

|

Champlain Heights, Vancouver East Real Estate

|

Cloverdale BC, Cloverdale Real Estate

|

Cloverdale BC, Surrey Real Estate

|

Cloverdale Real Estate

|

Coal Harbour, Vancouver West Real Estate

|

Coaquitlam

|

College Park PM, Port Moody Real Estate

|

Collingwood VE, Vancouver East Real Estate

|

Coquitlam

|

Coquitlam West, Coquitlam Real Estate

|

Downtown NW, New Westminster Real Estate

|

Downtown VW, Vancouver West

|

Downtown VW, Vancouver West Real Estate

|

Eagleridge, Coquitlam Real Estate

|

False Creek North, Vancouver West

|

Fraserview NW, New Westminster

|

Fraserview NW, New Westminster Real Estate

|

Fraserview VE, Vancouver East Real Estate

|

GlenBrooke North, New Westminster Real Estate

|

Grandview Surrey, Surrey Real Estate

|

Harrison Hot Springs Real Estate

|

Hastings, Vancouver East Real Estate

|

Highgate, Burnaby South Real Estate

|

Hockaday, Coquitlam Real Estate

|

January 2014 Sales in Greater Vancouver

|

Metrotown, Burnaby South Real Estate

|

New Horizons, Coquitlam Real Estate

|

New Westminster Real Estate

|

Port Moody

|

Port Moody Real Estate

|

Quay, New Westminster Real Estate

|

Queensborough, New Westminster Real Estate

|

Richmond Real Estate

|

Riverdale RI, Richmond Real Estate

|

Riverwood, Port Coquitlam Real Estate

|

Sapperton, New Westminster Real Estate

|

Simon Fraser Univer., Burnaby North Real Estate

|

Surrey

|

The Heights NW, New Westminster

|

The Heights NW, New Westminster Real Estate

|

Tsawwassen Central, Tsawwassen Real Estate

|

Uptown NW, New Westminster Real Estate

|

Uptown, New Westminster Real Estate

|

Vancouver

|

Vancouver East Real Estate

|

Videocast of January 2014 sales

|

Walnut Grove, Langley Real Estate

|

West Central, Maple Ridge Real Estate

|

West End VW, Vancouver West Real Estate

|

Whalley, North Surrey Real Estate

|

Whalley, Surrey Real Estate

|

Willoughby Heights, Langley Real Estate

|

Subscribe with RSS Reader

Subscribe with RSS Reader