Posted on

October 29, 2021

by

Steve Flynn

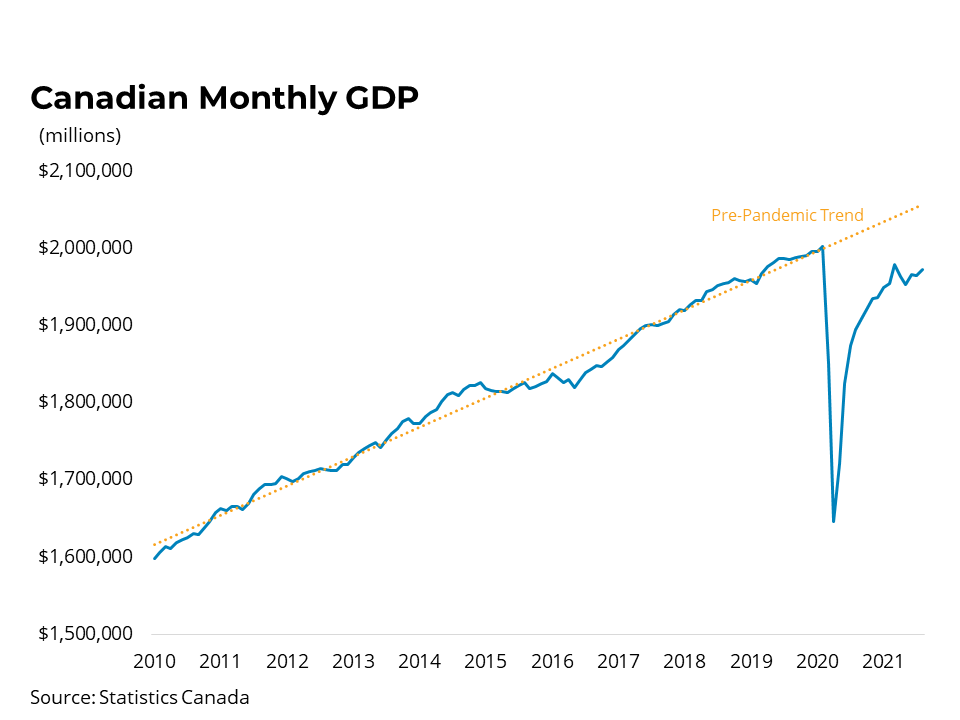

The Canadian economy expanded by 0.4 per cent. That is below Statistics Canada's original preliminary estimate of 0.7 per cent and follows a slight contraction in July. The continued easing of restrictions was a main driver of growth in August, with increases in the accommodation and food service, retail trade and transportation sectors making strong contributions.

However, Statistics Canada's preliminary estimate for September GDP is showing flat growth, which points to overall third quarter growth registering about 2 per cent on an annualized basis, in line with third quarter growth in the United States and well under the Bank of Canada's more rosy forecast of 5.5 per cent. The middle quarters of 2021 have been fairly disappointing in terms of economic growth, with the economy contracting in the second quarter and underwhelming in the third. However, we anticipate that the economy will bounce back in the fourth quarter with Canadian real GDP expanding 4 per cent and carrying momentum into 2022.

Copyright British Columbia Real Estate Association. Reprinted with permission.

Posted on

October 29, 2021

by

Steve Flynn

The British Columbia Real Estate Association (BCREA) released its 2021 Fourth Quarter Housing Forecast today.

Multiple Listing Service® (MLS®) residential sales in the province are forecast to rise 29 per cent to 121,450 units this year, after recording 94,013 sales in 2020. In 2022, MLS® residential sales are forecast to pull back 15 per cent to 102,750 units.

“After a frenzied start to the year, activity in BC housing markets has settled back to a level that is broadly in-line with long-run trends. The strength of the first half of this year has sales on track to easily break the previous record for annual sales,” said BCREA Chief Economist, Brendon Ogmundson. “While we do not anticipate a repeat of the record-setting market of 2021, we do expect housing market activity to remain vigorous in 2022,” added Ogmundson.

Given strong demand and very low active listings, particularly in smaller markets around BC, the average home price in BC is projected to rise 17 per cent in 2021. Prices are forecast to rise about 3 per cent in 2022 as the composition of home sales changes due to normalizing demand for single-family homes and a recovery in active listings helps the market balance out.

Copyright British Columbia Real Estate Association. Reprinted with permission.

Posted on

October 28, 2021

by

Steve Flynn

The Bank of Canada maintained its overnight rate at 0.25 per cent this morning, a level it considers its effective lower bound. The Bank reiterated what it calls "extraordinary forward guidance" in committing to leaving the overnight rate at 0.25 per cent until slack in the economy is absorbed and inflation sustainably returns to its 2 per cent target. The Bank projects that will not occur until near the third quarter of 2022. Of note, the Bank is ending its quantitative easing program of bond purchases and moving into what it terms the reinvestment phase where its Government of Canada bond purchases will be made solely to replace currently maturing bonds. In its statement, the Bank noted that growth in Canada is robust and it expects the economy will grow 5 per cent this year and 4.5 per cent in 2022. However, shortages of manufacturing inputs and labour are limiting the economy's productive capacity in the short-term, leading to upward pressure on consumer prices. As a result, the Bank expects inflation to remain elevated into next year.

The Bank is currently challenged by the highly abnormal circumstance of an economy that is in many ways booming, from retail spending to the housing market, but one that is also suffering through significant supply side shocks from overwhelmed ports, global factory shutdowns and labour market shortages. The optimal monetary policy for the current environment is far from clear. The Bank's current timetable suggests a rate increase near the end of 2022, but we expect the Bank to take a cautious approach over the next year, carefully watching for signs that elevated inflation is becoming more persistent.

Copyright British Columbia Real Estate Association. Reprinted with permission.

Posted on

October 28, 2021

by

Steve Flynn

I have sold a property at 401 518 THIRTEENTH ST in New Westminster. Uptown New Westminster well maintained PENTHOUSE CONDO. Lovely and spacious 2 bed-rooms and 2 full bath with 2 side by side underground secure parking stalls and 1 locker. High vaulted ceiling with skylight in the second bedroom,, gas fireplace makes the spacious living room cozy and homey. Renovated with new floor and kitchen in 2020. The building has been fully rain screened which includes all new exterior, windows, roof, doors, and entrance,fences,balconies, patios & landscaping. Quiet ad safe Street, close to transit, schools, shopping, restaurants, and parks. Do not miss this opportunity to own a sweet home.

Posted on

October 21, 2021

by

Steve Flynn

Canadian prices, as measured by the Consumer Price Index (CPI), rose 4.4% on a year-over-year basis in September, rising at the fastest rate since 2003. On a month-over-month basis, the CPI was up 0.2% in September. The Bank of Canada's preferred measures of core inflation (which use techniques to strip out volatile elements) rose an average of 2.7% year-over-year in September. Major drivers of the year-over-year price increase included transportation prices (+9.1%), shelter (+4.8%) and food prices (+3.9%) partly on continuing supply-chain difficulties. The homeowner replacement cost index, which measures the cost of replacing home structures, rose 14.4% year-over-year in September, which was the fastest rate since the 1980s. In BC, consumer prices were up 0.15% month-over-month, and up 3.5% on a year-over-year basis.

Inflation continues to run ahead of the Bank of Canada's 2 per cent target. The driving force behind rising prices is still isolated to a few categories of spending. In particular, the rising price of gasoline and the run-up in Canadian home prices since last year. Those categories alone accounted for about half of the observed inflation in September. Home prices in Canada are beginning to flatten out, which should mean a fading impact on inflation over the next year. Likewise, the impact of gas prices should continue to decline as base-year effects have less influence. Other issues putting upward pressure on consumer prices are being driven by bottlenecks and supply shortages. Those shortages are unlikely to resolve quickly and so we anticipate that the current elevated rate of inflation will linger for some time to come. Inflation that is lingering above target for an extended period may put some pressure on the Bank of Canada, though we still expect the first rate increase to come toward the end of 2022.

Copyright British Columbia Real Estate Association. Reprinted with permission.

Posted on

October 19, 2021

by

Steve Flynn

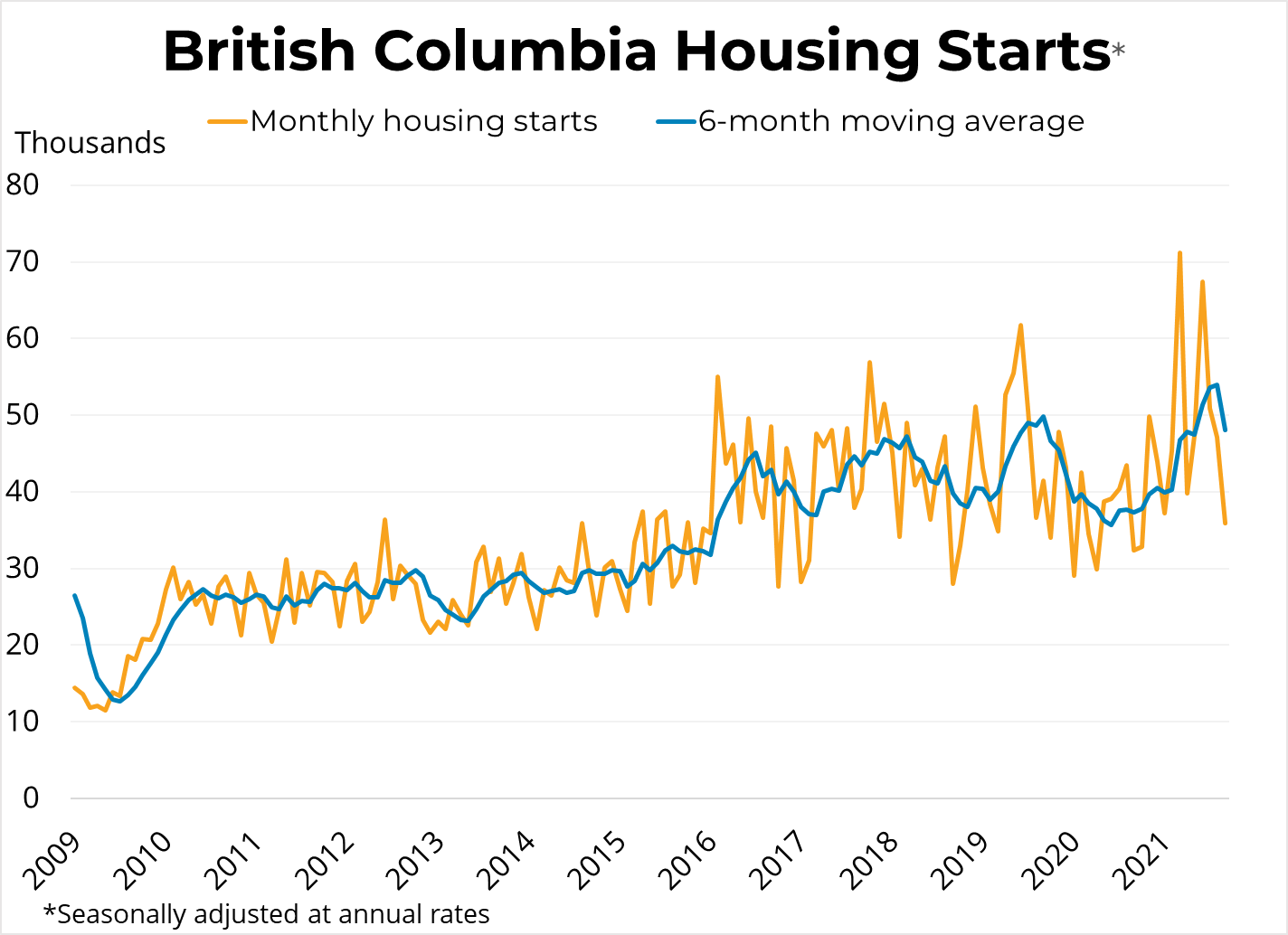

Canadian housing starts declined for the fourth consecutive month in September, but remain strong compared to typical pre-pandemic activity. Housing starts decreased by 11.6k to 251.2k units (-4.4% m/m) in September at a seasonally-adjusted annual rate (SAAR). Comparing year-over-year, starts were up significantly from September of 2020 (20.1% y/y). Single-detached housing starts dipped 5% in September to 76.7k, while multi-family and others declined 4% to 174.4k (SAAR).

In British Columbia, starts declined for a third consecutive month, dropping sharply by 23.7% m/m to 35.9k units SAAR in all areas of the province. Single-detached starts rose 9.6% m/m to 7.9k units while multi-family starts offset this growth with a 32.5% decline to 23.7k units. Despite this, starts in the province remained 11% above the levels from September 2020. BC's six-month moving average for starts declined sharply following three months of gains.

Copyright British Columbia Real Estate Association. Reprinted with permission.

Posted on

October 15, 2021

by

Steve Flynn

The British Columbia Real Estate Association (BCREA) reports that a total of 9,164 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in September 2021, a decrease of 19.9 per cent from September 2020. The average MLS® residential price in BC was $913,471, a 14 per cent increase from $801,241 recorded in September 2020. Total sales dollar volume was $8.4 billion, an 8.6 per cent decline from last year.

“Home sales have settled at levels that are slightly above long-term average,” said BCREA Chief Economist Brendon Ogmundson. “The main story in all markets continues to be a severe lack of listings supply, particularly in Fraser Valley, Vancouver Island and Interior markets.”

Total active residential listings were down 36.8 per cent year-over-year in September for the province as a whole and were more than more than 50 per cent below last September’s levels in the Fraser Valley and Victoria.

Year-to-date, BC residential sales dollar volume was up 81.8 per cent to $90.4 billion, compared to the same period in 2020. Residential unit sales were up 52.4 per cent to 99,182 units, while the average MLS® residential price was up 19.3 per cent to $911,195.

Copyright British Columbia Real Estate Association. Reprinted with permission.

Posted on

October 9, 2021

by

Steve Flynn

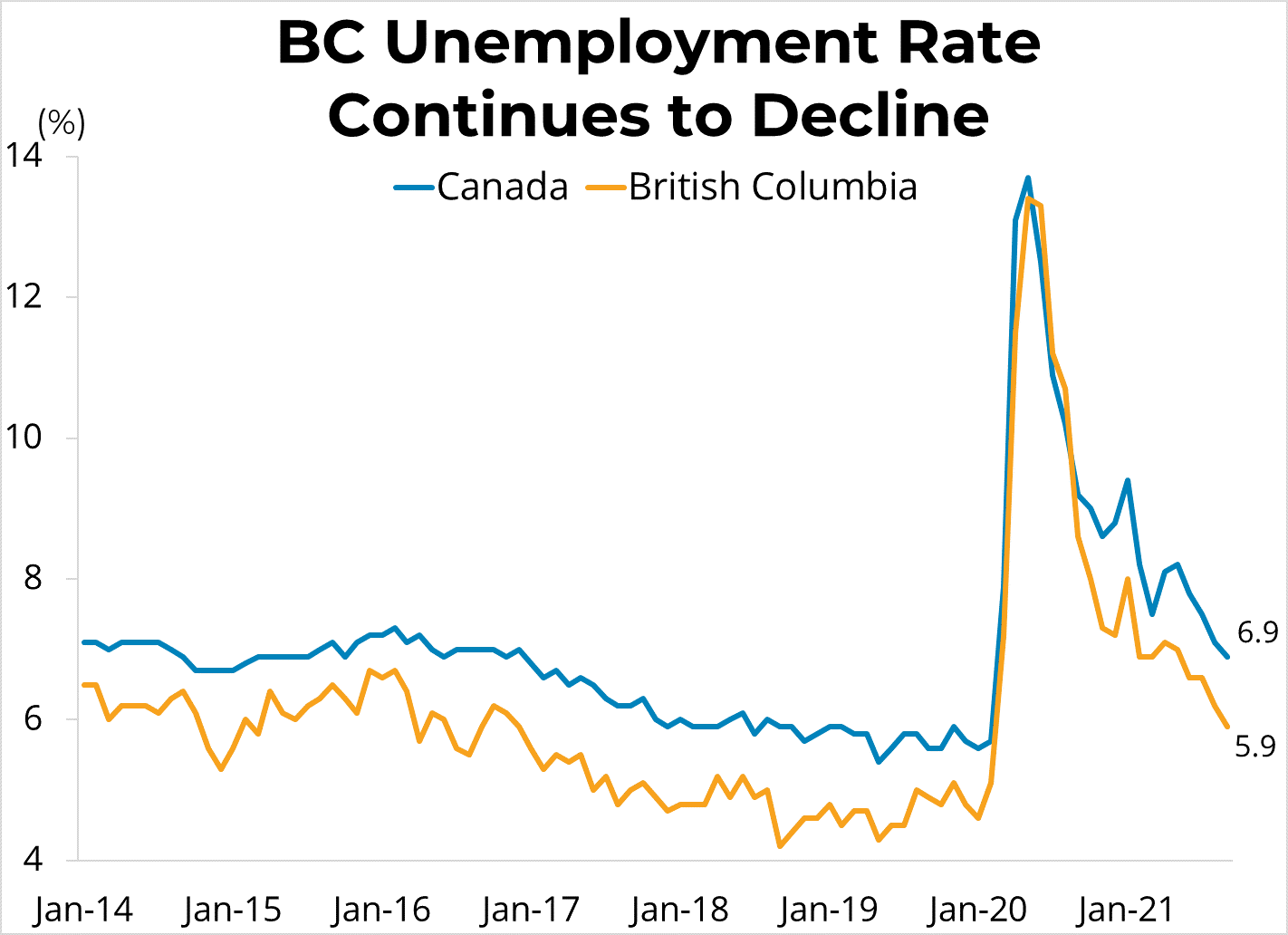

Canadian employment grew for the fourth consecutive month in September, rising by 157,000 to 19.13 million (0.8%, m/m). During the survey period, several provinces had reintroduced or planned to reintroduce vaccine passports and indoor masking. Restrictions on international travelers entering the country were eased on September 7th, likely boosting tourism employment.

The current employment level matches the figure from February 2020, meaning that the job market has technically erased the losses from the pandemic. Due to population growth, the employment rate remains 0.9 percentage points below February 2020 at 60.9%. The Canadian unemployment rate declined for a fourth consecutive month to 6.9%, the lowest level since the onset of the pandemic.

In BC, employment grew by 12,300 to 2.682 million (0.46%, m/m), once again hitting the highest level since the pandemic began. For the fourth consecutive month, British Columbia was the sole province with employment notably above its pre-pandemic level. The unemployment rate declined by 0.3 in September to 5.9%, the lowest level since the pandemic began. BC has the third lowest unemployment rate in Canada, following Manitoba and Quebec.

Copyright British Columbia Real Estate Association. Reprinted with permission.

Posted on

October 3, 2021

by

Steve Flynn

Home sale activity remains elevated across Metro Vancouver’s* housing market while the pace of homes being listed for sale continues to follow long-term averages:

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 3,149 in September 2021, a 13.6 per cent decrease from the 3,643 sales recorded in September 2020, and a 0.1 per cent decrease from the 3,152 homes sold in August 2021. Last month’s sales were 20.8 per cent above the 10-year September sales average.

There were 5,171 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in September 2021. This represents a 19.2 per cent decrease compared to the 6,402 homes listed in September 2020 and a 28.2 per cent increase compared to August 2021 when 4,032 homes were listed. September’s new listings were 1.2 per cent below the 10-year average for the month.

“The summer trend of above-average home sales and historically typical new listings activity continued in Metro Vancouver last month. Although this is keeping the overall supply of homes for sale low, we’re not seeing the same upward intensity on home prices today as we did in the spring,” Keith Stewart, REBGV economist said. “Home price trends will, however, vary depending on property type and neighborhood, so it’s important to take a hyperlocal look at your location and property category of choice before making a home buying or selling decision.”

The total number of homes currently listed for sale on the MLS® system in Metro Vancouver is 9,236. This is a 29.5 per cent decrease compared to September 2020 (13,096), a 2.6 per cent increase compared to August 2021 (9,005) and is 27.7 per cent below the 10-year average for the month.

For all property types, the sales-to-active listings ratio for September 2021 is 34.1 per cent. By property type, the ratio is 25.5 per cent for detached homes, 53.1 per cent for townhomes, and 36.7 per cent for apartments. Generally, analysts say downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

“The total inventory of homes for sale remains insufficient to meet the demand in today’s market. This scarcity limits peoples’ purchasing options and ultimately adds upward pressure on home prices,” Stewart said. “With the federal election now behind us, we hope to see governments at all levels work with the construction industry to streamline the creation of a more abundant and diverse supply of housing options.”

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $ 1,186,100. This represents a 13.8 per cent increase over September 2020 and a 0.8 per cent increase compared to August 2021.

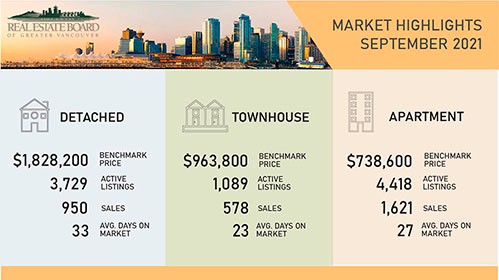

Sales of detached homes in September 2021 reached 950, a 27.9 per cent decrease from the 1,317 detached sales recorded in September 2020. The benchmark price for a detached home is $1,828,200. This represents a 20.4 per cent increase from September 2020 and a 1.2 per cent increase compared to August 2021.

Sales of apartment homes reached 1,621 in September 2021, a 1.6 per cent increase compared to the 1,596 sales in September 2020. The benchmark price of an apartment home is $738,600. This represents an 8.4 per cent increase from September 2020 and a 0.5 per cent increase compared to August 2021.

Attached home sales in September 2021 totalled 578, a 20.8 per cent decrease compared to the 730 sales in September 2020. The benchmark price of an attached home is $963,800. This represents a 17.5 per cent increase from September 2020 and a 1.2 per cent increase compared to August 2021.

* Areas covered by the Real Estate Board of Greater Vancouver include: Burnaby, Coquitlam, Maple Ridge, New Westminster, North Vancouver, Pitt Meadows, Port Coquitlam, Port Moody, Richmond, South Delta, Squamish, Sunshine Coast, Vancouver, West Vancouver, and Whistler.

Copyright British Columbia Real Estate Association. Reprinted with permission.

Posted on

October 3, 2021

by

Steve Flynn

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver* is currently $1,186,100. This represents a 13.8% increase from September 2020 and 0.8% increase compared to August 2021.

Specifically:

- The benchmark price for detached homes increased 1.2% from August.

- The benchmark price for townhouses increased 1.2% from August.

- The benchmark price for apartment/condos increased 0.5% from August.

* Areas covered by the Real Estate Board of Greater Vancouver include: Burnaby, Coquitlam, Maple Ridge, New Westminster, North Vancouver, Pitt Meadows, Port Coquitlam, Port Moody, Richmond, South Delta, Squamish, Sunshine Coast, Vancouver, West Vancouver, and Whistler.

Copyright British Columbia Real Estate Association. Reprinted with permission.

Posted on

October 1, 2021

by

Steve Flynn

The Canadian economy contracted 0.1 per cent in July following growth of 0.6 per cent in June. The level of GDP remains about 2 per cent below its pre-pandemic level of February 2020. The majority of Canadian industries actually grew in July, led by re-opening of many provincial economies which led to a strong increase in the accommodation and food services sectors. That strength was more than offset, however, by declines in agriculture, manufacturing and wholesale trade. On the bright side, Statistics Canada's preliminary estimate for August real GDP is showing a strong bounce back, with output across the economy rising 0.7 per cent on a monthly basis.

Given today's release, we are tracking 3rd quarter real GDP growth in Canada at about 3.5 per cent. The pace of the recovery remains uncertain due to the pandemic and especially the Delta variant driven rise in cases around the country. We saw this uncertainty at play in the second quarter when the economy unexpectedly contracted and again, though to a lesser extent, in July. We anticipate that some of the expected acceleration of economic growth may now be pushed into the fourth quarter of 2021 and the first half of 2022. As a result, we have trimmed our forecast for Canadian real GDP growth from about 6 per cent in 2021 down to 5 per cent.

Copyright British Columbia Real Estate Association. Reprinted with permission.

Categories:

Abbotsford West, Abbotsford Real Estate

|

Bolivar Heights, North Surrey Real Estate

|

Brentwood Park, Burnaby North Real Estate

|

Brighouse, Richmond Real Estate

|

Burnaby

|

Burnaby Real Estate

|

Burnaby South Real Estate

|

Cape Horn, Coquitlam Real Estate

|

Cariboo, Burnaby North Real Estate

|

Central BN, Burnaby North Real Estate

|

Central Coquitlam, Coquitlam

|

Central Coquitlam, Coquitlam Real Estate

|

Champlain Heights, Vancouver East

|

Champlain Heights, Vancouver East Real Estate

|

Cloverdale BC, Cloverdale Real Estate

|

Cloverdale BC, Surrey Real Estate

|

Cloverdale Real Estate

|

Coal Harbour, Vancouver West Real Estate

|

Coaquitlam

|

College Park PM, Port Moody Real Estate

|

Collingwood VE, Vancouver East Real Estate

|

Coquitlam

|

Coquitlam West, Coquitlam Real Estate

|

Downtown NW, New Westminster Real Estate

|

Downtown VW, Vancouver West

|

Downtown VW, Vancouver West Real Estate

|

Eagleridge, Coquitlam Real Estate

|

False Creek North, Vancouver West

|

Fraserview NW, New Westminster

|

Fraserview NW, New Westminster Real Estate

|

Fraserview VE, Vancouver East Real Estate

|

GlenBrooke North, New Westminster Real Estate

|

Grandview Surrey, Surrey Real Estate

|

Harrison Hot Springs Real Estate

|

Hastings, Vancouver East Real Estate

|

Highgate, Burnaby South Real Estate

|

Hockaday, Coquitlam Real Estate

|

January 2014 Sales in Greater Vancouver

|

Metrotown, Burnaby South Real Estate

|

New Horizons, Coquitlam Real Estate

|

New Westminster Real Estate

|

Port Moody

|

Port Moody Real Estate

|

Quay, New Westminster Real Estate

|

Queensborough, New Westminster Real Estate

|

Richmond Real Estate

|

Riverdale RI, Richmond Real Estate

|

Riverwood, Port Coquitlam Real Estate

|

Sapperton, New Westminster Real Estate

|

Simon Fraser Univer., Burnaby North Real Estate

|

Surrey

|

The Heights NW, New Westminster

|

The Heights NW, New Westminster Real Estate

|

Tsawwassen Central, Tsawwassen Real Estate

|

Uptown NW, New Westminster Real Estate

|

Uptown, New Westminster Real Estate

|

Vancouver

|

Vancouver East Real Estate

|

Videocast of January 2014 sales

|

Walnut Grove, Langley Real Estate

|

West Central, Maple Ridge Real Estate

|

West End VW, Vancouver West Real Estate

|

Whalley, North Surrey Real Estate

|

Whalley, Surrey Real Estate

|

Willoughby Heights, Langley Real Estate

|

Subscribe with RSS Reader

Subscribe with RSS Reader